When purchasing a house in the United States, it is important to understand the differences from Japan. I tried to summarize the differences between Japan and the United States.

Rich wealth of existing homes Ma over packet

Newly built in Japan is strong, the value of real estate generally decreases as the age of years gets older.

In the United States, secondhand houses are overwhelmingly traded more than new houses, but "price location" is a very big factor in price appraisal. If the location is good, the value is high even if the house is old, and in areas where the location is bad and unpopular, the value does not rise so much no matter how good the building is.

Also, if the owner does not maintain the house after purchase, the price will be low, but even if the age is old, the maintenance is pervasive and you can keep high asset value if upgraded / remodeled. It is worthwhile if you manage not only one house but also its communities and complexes.

The buyer over the unnecessary brokerage fees

When buying second-hand houses in Japan, both the seller and the buyer will pay an intermediary fee.

Meanwhile, in the United States, the seller pays the brokerage commission (commission to real estate agents) in full, so buyers do not need to pay brokerage fee. Brokerage fee borne by seller is generally 5 to 6% (California), it is divided by agent of seller and agent of buyer (3% in case of 6%, 2.5% in case of 5% Is common).

Housing and Russia over emissions is the year of age without restriction

In Japan, the mortgage has age restrictions when borrowing and paying off (generally, borrowing is 20 to 70 years old, payment age under 80 years old). So it is difficult to borrow a long-term loan from a middle-aged and elderly.

In America, there is no age limit for mortgage loans. In the examination of the mortgage, the credit history, the down payment ratio, the employment history, the income and repayment burden ratio, the account balance, and the evaluation of the collateral value for the property are checked against the borrowing individual (Details will be explained in another chapter.) Long-term loans will last up to 30 years, but if finance status is good regardless of age, it is possible to borrow a loan even in the long run.

Capital production value reasons for going up

America has a population three times that of Japan and a land area of 27 times. Even though terrorism and economic recession reduced the number of visas issued to foreigners, it is widely open as a basic immigration policy, so it is expected that the population flowing into the United States will continue to increase I will.

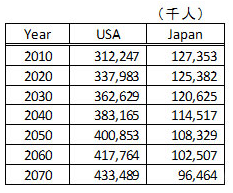

In the next 50 years, Japan will have a population of less than 100 million people, but it is expected that the number of the US will increase to more than 400 million, plus more than 100 million from the current about 300 million (Table 1).

Table 1: Population Trend Forecast (USA · Japan)

World Population Prospects: The 2012 Revision

(United Nations, Department of Economic and Social Affairs)

http://esa.un.org/unpd/wpp/unpp/panel_population.htm

From what we can say from this situation, we can predict that house demand will remain high without declining.

Also, it is said that in the United States you will change your home once averaged seven years. Living in general according to changes in lifestyle such as marriage, child rearing, child's nesting, and retirement from a single age. In addition to this, the area of the workplace may change greatly due to career change or promotion, so it may be because there are many cases to change the residence accordingly.

In other words, Americans always have the idea that the house is not shopping once in a lifetime, but the idea of buying according to the environment, so there is always demand for purchase of housing and rental demand. And while the price of the property changes depending on market conditions, it will rise with inflation in the long run.

Against this background, you can say that buying a house leads to asset formation in the United States.

![]()

■ESTATE PROPERTIES

Real estate service

Residential home sales / Multi unit property sale / Lease

■H2N

We are a consultant in the real estate market where we

specialize in marketing, coordinating business tours and events.

Contact:310-951-8233 info@H2Nusa.com