The process of buying real estate in the United States differs from state to state, but here we will explain California as an example.

1. Consultation

Have time for real estate agents and consultation, please consult with us about the purpose of purchase, the condition and priority of the property, the timing of arrival, the desired price range and the preparation situation of finance. Real estate agents will introduce trends in the real estate market and property information in the desired area.

2. Mortgage consultation and preparation

In parallel with the consultation, consult the loan to the mortgage officer and confirm the "loan amount that can be borrowed" according to the above item. It can be said that only when this is clarified, research and observation are completed for concrete subject property.

And prepare "Pre-Approval Letter" stating purchase schedule amount and loan amount. This letter is necessary when putting an offer into the property you want to buy.

3. Research and tour of property information

Research the property in the range of purchase price and start observing. Visiting the room basically accompanies the real estate agents, but you can also take a trip to the room indoors yourself at the weekend's open house. We will narrow down the objects of the property you want while looking at the region and market price.

A specialized site MLS (= Multiple Listing Service) to search among real estate agents is obliged to post information promptly upon receipt of sales requests for properties. When there are different MLS operating organizations in each region, when information is updated there, basically about 2 days will be delivered to real estate sites of affiliated private companies.

<General real estate website>

Realtor.com

Zillow

trulia

4. Offer submission

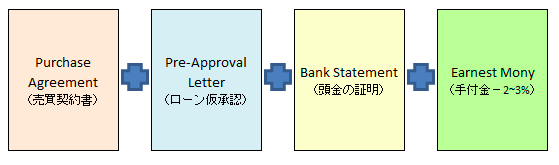

When you find the property you want to purchase, you create an offer and submit it to the seller side. The offer is a page of 8 pages called "Residential Purchase Agreement and Joint Escrow Instructions (abbreviated as Pacific Agreement = RPA)", and the price to be purchased, the contract (escrow) period, the amount of deposit (= Earnest Money, 2% to 3% of the price), mortgage amount, other hope.

We will submit Earnest Money checks, Pre / Approval letters for mortgages and bank statements that can prove the amount of the down payment together with the offer.

From the seller for the offer you will receive either an acceptance, conditional receipt (counter offer) or refusal. If a counter offer comes, we will consider the conditions and submit counter offers from here again. Ultimately when both parties agree, the contract will start and escrow will be opened.

5. Contract start (Escrow opening)

Escrow is a third party company that stands between buyer and seller to do sales contract fairly. We arrange documents, change contract contents, manage down payments and expense, and settle at the end of contract based on sales contract. For details, please refer to the "Escrow" page.

6. Loan application · Inspection etc.

When the sales contract is accepted, during the escrow period, the buyer will make a mortgage application, real estate appraisal, home inspection, review of the disclosure document etc. If you need to solve something or repair, you have the opportunity to request again. For details, please refer to the "Escrow" page.

7. Transfer of ownership transfer and termination of contract

When the mortgage is approved, we will make the final signature of the (NOTARY PUBLIC) loan document by notary witness. When the deposit is transferred to the designated account of escrow and the loan and ownership transfer are registered, the contract will be terminated.

![]()

■ESTATE PROPERTIES

Real estate service

Residential home sales / Multi unit property sale / Lease

■H2N

We are a consultant in the real estate market where we

specialize in marketing, coordinating business tours and events.

Contact:310-951-8233 info@H2Nusa.com